Portugal has long been a favourite location for foreign nationals from the UK, US, and other European countries, with short-haul flights, affordable living, excellent infrastructure, a mild climate and beautiful cities and coastlines.

Prospective expatriates have countless considerations when choosing a destination, from visa availability to tax planning, their children’s education and career opportunities.

In this brief guide, we have summarised some key aspects of living in Portugal as an expat. More information is available in our free downloadable Portuguese Residency Guide.

Salaries and Employment for Expats in Portugal

While many businesses and employers only hire fluent Portuguese speakers, there are multiple ways to work remotely, continue a professional career, or retrain to fill skills shortage gaps within the Portuguese workforce.

IT and software are in high demand, with English-speaking developers commanding premium salaries and employment benefits, especially in and around Lisbon.

Foreign national professionals are also sought after both to serve the growing expatriate community and to provide international expertise in:

- Architecture

- Accountancy

- Law

- Engineering

Tourism is another growing, vibrant industry. Most roles and business opportunities are located around key areas such as the Algarve, Porto, and Lisbon, where tourism contributes substantially to local and national economies.

Average salaries are roughly €2,750 monthly compared to £2,313 (€2,608) in the UK, $5,911 (€5,449) in the US and €2,790 across Europe. As in any country, wages are significantly higher for senior roles and professionals.

Paying Tax in Portugal

Your tax position will depend on whether you are a permanent, taxpaying resident or categorised as a non-resident. Tax authorities will assess this against the number of days per year you live in Portugal and whether you have a business or place of work and primary residence in the country.

Residents pay tax on all worldwide income based on progressive tax rate bands, varying from 14.5% to 48%. Tax thresholds are due to increase slightly in 2023, confirmed in the October 2022 draft budget, making tax liabilities marginally lower.

Capital gains are normally taxed at a 28% flat rate, but short-term assets sold after less than a year will be taxed at the scaled rates in 2023 if the profit is £78,834 or above: the top tax band.

Non-residents must pay income tax on earnings that originate in Portugal, based on a 25% flat rate. However, foreign nationals that move to Portugal under the Non-Habitual Resident programme benefit from a range of tax advantages, including a 10% flat rate income tax on pensions from overseas and a lower 20% flat rate income tax levy.

It is advisable to seek advice about structuring your income and assets to maximise tax efficiency before an international move. Other relevant factors may include personal deductions for children and tax incentives for young people studying for professional qualifications.

The 2023 income tax bands for residents are as below:

| Taxable Income | Tax Rate |

| Up to €7,479 | 14.5% |

| €7,479 – €11,284 | 23% |

| €11,284 – €15,992 | 26.5% |

| €15,992 – €20,700 | 28.5% |

| €20,700 – €26,355 | 35% |

| €26,355 – €38,632 | 37% |

| €38,632 – €50,483 | 43.5% |

| €50,483 – €78,834 | 45% |

| €78,834 and above | 48% |

Portugal does not levy a wealth tax, although higher-value residential homes may be liable to the Imposto Municipal Sobre Imóveis (IMI), a property tax charged at 0.3% to 0.8% based on the property age, valuation, and size.

Portuguese Residency and Visas

There are several routes to residency, depending on the type of visa you qualify for. The standard process is to apply for a short-term residence visa, extending this to a one-year Autorizacao de Residencia. This permit renews annually, then every two years, and can be upgraded to a permanent visa after five years, depending on meeting all the requirements and criteria.

Non-EU foreign nationals can also apply for residency, leading to citizenship, through the ‘golden visa’ programme, which requires applicants to invest in the economy or purchase a property, with options such as:

- Buying residential or commercial property for €500,000 or above, with a lower threshold for properties in low population regions.

- Purchasing a renovation property over 30 years old for €350,000 or above, again with a reduced threshold for more rural areas.

- Investing €500,000 in a business, creating at least five permanent roles, or creating ten employment positions.

- Transferring capital of €1.5 million into a Portuguese bank account or depositing the same value into an approved investment scheme.

Eligible residents can apply for permanent residency after five years and citizenship after six.

Cost of Living In Portugal

Portugal is generally more affordable than the UK, although properties in exclusive areas around the Algarve are similarly priced. Residential homes in this region start from around £325,000 although larger plots, coastal views or private pools come at a premium.

Many expats choose to live in gated estates, which have additional costs such as an annual service charge – roughly £1,500 to £3,000 per year for security, amenities such as communal pools and resident parking.

Overall, Portugal is cost-effective, with average prices as follows:

- Consumer prices: 25.3% lower than in the UK.

- Rental costs: an average of 27.3% less expensive.

- Groceries: 23.7% lower than UK average prices.

- Restaurants: 41.2% lower priced than in the UK.

Of course, Lisbon is more expensive than rural communities or quieter coastal towns, but living in the capital is still 30% to 50% more affordable than London.

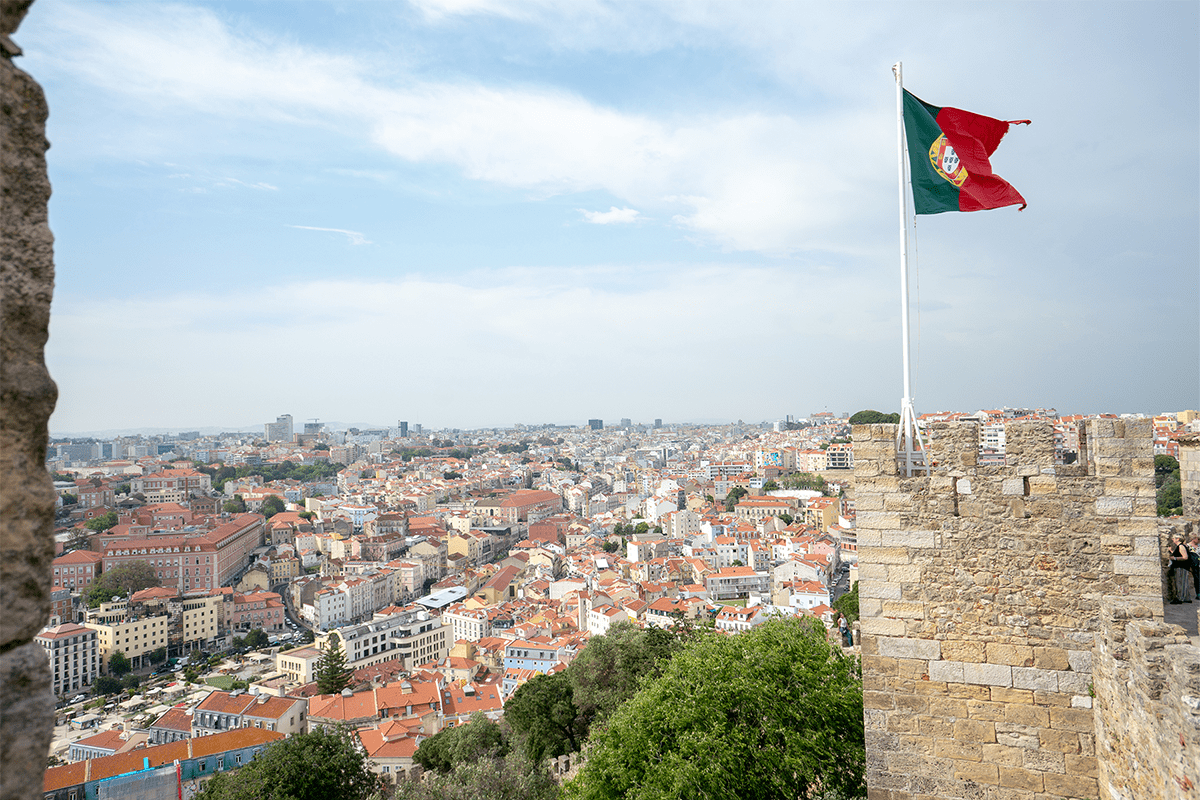

The Best Places for Expats Living in Portugal

Portugal is a beautiful country with countless rivers, valleys, beaches, rustic villages and thriving cities. Your choice of location will impact your living costs, commuting times, business opportunities, access to education and healthcare, and the type of property you might choose to purchase.

Porto is found in the Douro River region in the north and is the second-largest city with a dedicated airport. This city has a historic centre designed as a UNESCO World Heritage Site.

The city outskirts are much quieter and more relaxed, and properties range from modern apartments to generous family properties. Seafront homes in Madalena and Lavadores are popular with expats.

Braga is another desirable choice, also in the north and the oldest city in Portugal. The distinctive narrow lanes, boutiques and cafes sit alongside ancient churches.

There are rare opportunities to purchase properties in the old quarter. Still, families often prefer the area around the Universidade do Minho or buying a larger property in one of the villages within driving distance – many are renovation projects.

Finally, Aveiro is found in central Portugal, famous for canals, gondolas, and architecture, with a far smaller tourist population, and therefore a prime option for retirees. The city centre is modern and heavily pedestrianised, with road links to Lisbon and Porto.

We hope the information in this article is helpful and provides insight into the many decisions expats have when planning a move to Portugal.

For further advice and guidance, please contact Chase Buchanan’s Portuguese team, who offer financial expertise and local knowledge about working, paying taxes and living in Portugal.

*Information correct as at January 2023