Last Updated on 8th October 2025

The French government reformed its wealth tax system in 2018, introducing a much reduced scheme that isn’t strictly a wealth tax, at least not in comparison with other wealth tax initiatives that charge additional taxes based on the value of each taxpayer’s estate.

Instead, the French wealth tax is better described as a property tax since it levies a charge based solely on real estate assets, with a significantly tighter scope than the old Impôt de Solidarité sur la Fortune (ISF), also known as the solidarity wealth tax.

Now called the Impôt sur la Fortune Immobilière or IFI, this property tax is payable by both tax residents and French citizens living abroad, as well as non-residents with French real estate portfolios—but only if the net value of their property portfolio exceeds €1.3 million.

Clarifying the Rates and Scope of the French Property Wealth Tax

Each year, taxpayers and those with French property are assessed on 1st January to determine the net value of all real estate assets, either within France for those living elsewhere or worldwide property assets for residents.

The previous system charged a wealth tax on a broader range of assets, including savings accounts, investment products, vehicles, jewellery, and art.

Now, the wealth tax concerns only property ownership. The threshold to become subject to the tax is €1.3 million, although in effect, only the initial €800,000 of real estate assets remain exempt.

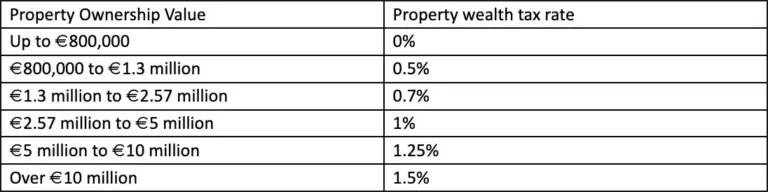

Actual rates vary between 0.5% and 1.5% and apply solely to non-professional properties, primarily linked to residential homes, investment real estate and rental assets rather than commercial premises or agricultural land.

The taxable charges are as follows, depending on the total value of all real estate owned and subject to taxation in France:

Wealth Tax Exemptions for New French Tax Residents

Most foreign national expats who register as tax residents within France are exempt from paying the wealth tax against international real estate assets for the first five years.

The precise calculations can be slightly complex, but they effectively mean that any obligations are limited to French property assets for five years from the calendar year in which the person became a tax resident—even if they were previously living part of the year in France as a non-resident or were obligated to pay the property wealth tax as a non-resident property owner.

Calculating Your French Wealth Tax Liabilities

Like most taxation charges in France, the property wealth tax is based on a per-household basis, which means that the assets of all individuals living within the same household count towards the tax threshold, including:

- Married couples

- Cohabiting and civil partners

- Minor children under 18

Adult children are subject to separate tax assessments even if they are otherwise considered part of the same household, for income tax purposes.

Along with the market value of properties, the tax evaluation should take into account the deductions that can reduce the amount payable or potentially lower the overall value of real estate to below the threshold.

Primary residences, where these are proven to be your main home, are discounted by a 30% rate, and this lower valuation is used to calculate your total real estate ownership value.

Qualifying charitable donations can also reduce your IFI tax charge by up to 75% of the contributions or donations made, although this deduction is capped at a maximum of €50,000.

Outstanding debts linked to the property can also be deducted from the valuation before identifying whether you hit the wealth tax threshold, which includes any existing mortgage or financing against the property, with further discounting options for rental properties that you own but that have sitting tenants.

Therefore, a property portfolio or one larger property close to the threshold may remain exempt from any tax obligation if the borrowing secured against the residence brings it beneath the qualifying tax threshold.

Budgeting and Preparing for French Wealth Taxes and Declarations

As noted, non-residents are liable to pay the property wealth tax only if they own real estate or alternative property rights within France that meet the threshold.

It is important to assess how that tax obligation may change if you later become a tax resident since properties in any location worldwide would then be included in the assessment and subject to the usual taxation rate.

Therefore, a global property portfolio could mean an expat living in France long term and paying income taxes in the country is both more likely to meet the threshold for wealth tax each year and will often pay a higher rate of tax based on the value of all combined properties—less the deductions listed earlier.

Some international investors choose to restructure their assets before becoming tax residents or relocating permanently to France to legally and compliantly mitigate any need to pay unnecessarily high taxes. One popular option is to gift properties to family members, especially where there has always been an expectation of passing on part of an estate to a loved one at some stage.

However, this may require careful planning since asset gifting, while perfectly possible, can also impact your inheritance planning, especially since most expats remain domiciles of their home countries and, therefore, must comply with localised inheritance tax rules and regulations.

Expert Assistance Calculating and Managing Your French Tax Obligations

The best way to ensure you understand whether the French property wealth tax will apply to your real estate, the amount of tax you might expect to pay each year, and how to manage your assets to maximise your tax efficiencies is to speak with a regulated, independent wealth manager or adviser to make informed decisions about the right way forward.

For more information about this French tax scheme, its effects on your long-term tax planning, or how to manage your property assets during an international relocation, please contact your nearest Chase Buchanan team or our Bordeaux office at any time.

All investments carry risk, including the potential loss of capital. You should carefully consider whether investing is suitable for you, taking into account your personal circumstances, financial situation, and risk tolerance.

*Information correct as at September 2024