Last Updated on 18th December 2025

The Cypriot tax regime offers varied potential benefits for UK nationals and tax residents, but the specifics of your tax obligations and declaration requirements will depend on several factors, such as whether you retain assets in the UK and the type of visa or residence permit you relocate under.

As with every international move, assessing your tax position and examining the options to restructure, transfer or retain income sources and investments is important to ensure you take advantage of all the available exemptions and allowances.

For example, British expats retiring to Cyprus long-term can opt to either pay a flat rate of 5% income tax against their foreign-source pension income over an exempt allowance of €3,420 or pay tax based on the normal income tax brackets – which could make a sizeable difference to your annual tax burden.

Clarifying Your Tax Residency Status When Moving to Cyprus From the UK

One of the first considerations is whether or not you are likely to be categorised as a tax resident, which requires careful analysis to ensure that, as a UK national, you declare and pay taxes in the proper jurisdiction.

Tax residency for third-country nationals moving from non-EU countries is determined based on factors such as:

- How many days per year you spend in Cyprus and the UK.

- The origin of your income or employment earnings from inside or outside the European Union.

- Where your family members and primary permanent residence are based.

British expats who are tax residents in Cyprus are liable for tax on their worldwide income, but interest and dividend income are taxed differently and separately from other earnings such as business income or a salary from employment. Instead, these earnings are taxed as defence contributions.

The advantage from an expat perspective is that non-Cypriot domiciles are exempt, with a domicile normally considered anybody born in Cyprus or who has lived there for at least 17 of the past 20 years.

Therefore, many British citizens enjoying life in Cyprus do not pay any tax on dividends or interest earnings for the first 17 years, regardless of whether they have a permanent residence permit.

Still, caution is necessary since, if British expats intend at some point to claim Cypriot domiciliary status as part of inheritance tax planning, this could affect their ability to claim exemption from defence contributions.

Taxation on Income for British Nationals Living in Cyprus

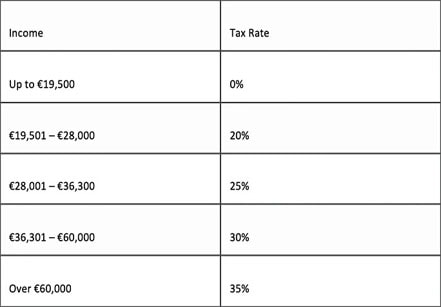

Cypriot personal income tax, or PIT, is charged against all income for residents outside of earnings taxed as defence contributions. Non-tax residents are subject to tax only on income from Cyprus, such as through employment in the local job market. Tax bands are as follows:

The obvious benefit for UK citizens who are higher-rate earners is that the upper tax bracket in Cyprus is 10% lower than in Britain, and personal allowances are greater – although the direct comparison between tax savings is less substantial for mid-level earners.

As we’ve mentioned, taxes on pension income can work in two ways. Expats receiving pension income from overseas either pay tax based on the brackets above or elect to pay a flat 5% income tax rate for pension income above €3,420.

UK nationals classified as Cypriot tax residents may be subject to tax against their worldwide pension income, including the State Pension, workplace and private pensions, and other products like annuities. Exceptions apply to government pension schemes which remain taxable in the country of origin.

Expats with an income that is taxed at source but who are also subject to Cypriot tax normally need to file appropriate claims to ensure they take advantage of double tax treaties and avoid paying tax twice on the same earnings.

Defence contributions, levied against income from interest and dividends, only apply to Cypriot domiciles and are charged at 17% against dividends and interest. However, interest from Cypriot government bonds is reduced to 3%.

Foreign nationals who own a rental property pay both personal income tax against their net profits and defence contributions of 3% on their gross income.

Inheritance and Capital Gains Taxes for Cypriot Residents

Cyprus does not levy a succession or inheritance tax of any kind. Tax residents registered with Cyprus immigration and with a valid Cypriot residence permit can also transfer assets to spouses, family members and relatives, including ‘third-degree’ relatives such as cousins and great-grandchildren, with no capital gains tax.

Other capital gains are taxable at 20%, but only those originating within Cyprus. Sales of property overseas, including in the UK, are exempt, and profits made on share disposals are often exempt, except for company shares linked to a business that owns property within Cyprus.

However, the caveat is that most British nationals will remain subject to UK inheritance tax unless registered as an overseas domicile.

According to UK inheritance tax law, any domicile, regardless of how long they have lived abroad, will normally be liable for inheritance tax, levied at 40% after allowances. UK-based assets are almost always taxable irrespective of whether you have since become domiciled abroad.

Another pitfall is that, although zero inheritance tax may seem appealing, the Cyprus government imposes forced heirship statutes. These rules are fairly common within the European Union and mean your estate is divided automatically between direct relatives who must receive a minimum percentage, even if your will states otherwise.

We advise expats to seek professional advice around structuring their estate, determining the likely future inheritance tax liability, and making informed decisions about the pros and cons of changing their residence status and country of domicile to Cyprus from the UK or applying for full Cyprus citizenship.

Visa Routes for UK Nationals Relocating to Cyprus

A final tax implication to bear in mind is that you may find that your visa route and whether you plan to apply for an EU passport after a minimum of seven years of residency affects your tax position as a UK citizen living in Cyprus.

Cyprus immigration rules and the impacts on your tax status vary considerably, where a Cyprus work visa or student visa is treated differently from applicants moving to Cyprus through the residency by investment scheme.

Moving to Cyprus From the UK as an Investor

The Residency by Investment Program allows foreign nationals to obtain permanent residency by investing in a Cypriot property worth at least €300,000, plus VAT. Applicants must also have an annual income of at least €50,000 plus €15,000 for a spouse and €10,000 for each dependent child or family member included on the application.

If you hold permanent residency and spend most of your time in Cyprus, you will usually become a tax resident, which may affect your taxes in the year of your relocation, when timings can be important.

Additionally, as tax residents, expats become eligible to access the General Healthcare System but must initially have private health insurance. The income used to meet the eligibility criteria for a permanent residence permit must be entirely from an overseas country.

There are positive and negative impacts, where becoming a Cypriot tax resident but maintaining an annual income from abroad into a Cypriot bank account could create a contrasting position.

You might need to claim appropriate tax credits through the double taxation agreements where income remains declarable in two countries and ensure you are aware of how currency fluctuations will affect the value of your income.

Living in Cyprus With a Temporary Residence Permit

UK nationals must meet visa requirements introduced post-Brexit, where any non-EU national requires a visa to be able to stay for over 90 days within any six-month period.

Temporary and renewable residency documents act as entry visas and normally have a finite expiry. However, it is possible to apply for a residence permit as a student, secure a work visa to take up a post in the job market or request visitor visas offered to citizens from outside the European Free Trade Association area.

Foreign nationals living primarily in Cyprus can apply for permanent residency after several years but, in the meantime, could be taxed as non-residents or tax-residents, depending on the terms of their temporary visa.

Changes to Taxation Considerations for Expats Relocating to Cyprus From 2024 Onward

Several reforms included within the Autumn 2024 budget may impact expatriates, with variations in the taxes they may need to budget for ahead of an international relocation. Important announcements include:

- The removal of exemptions against EU pension transfers, where UK expats transferring a fund to a Recognised Overseas Pension Scheme (ROPS) will no longer be exempt from paying the Overseas Transfer Charge (OTC) – a tax levied at 25%.

- The inclusion of pension benefits into the scope of Inheritance Tax (IHT), which could have ramifications for those intending to retire in Cyprus or with substantial pension savings, where there is a likelihood that a proportion of that wealth could be passed to a beneficiary in the future.

In any case, clarity around your tax residency status, your ongoing tax obligations, and how this may affect your net income and lifestyle expectations is key.

Further details about the difference between permanent residency and tax residency and how this is determined are available through our more detailed Guide to Taxes in Cyprus and Cyprus Residency Guide, both of which are free Chase Buchanan Wealth Management downloadable resources.

*Updated November 2024