Last Updated on 18th December 2025

As a small, peaceful and multicultural country known for its incredible cuisine, stunning architecture, highly developed healthcare system and rich heritage, retirement in Belgium is an aspiration for many,

From the old-world charm of Antwerp to the famous Gent canals, the lively communities in Brussels to the cobbled streets of Bruges, a UNESCO World Heritage city, Belgium is often overlooked but has a huge amount to offer, not least for retirees.

As with any international relocation, taxation is a key consideration, ensuring you have complete oversight over your access to pension benefits and know how transferring or restructuring your pension plans will impact your long-term finances.

Claiming the UK State Pension After Retiring in Belgium

Similarly to the UK, Belgian residents may be eligible for a domestic state pension, hold private pension funds, and have occupational pension schemes if they have lived and worked in Belgium before retirement. The standard retirement age in Belgium is 65, and if you have paid contributions to the social security system, you may be entitled to claim a statutory pension.

However, many expatriates relocate after retirement, so you may need to audit your assets, investments and pension plans before making decisions, collating a list of all your financial accounts and funds that may require attention.

The UK State Pension remains payable to expats living overseas. Because Belgium is part of the European Economic Area (EEA) and an EU member state, you will continue to receive the full pension with an annual increase, in line with the ‘triple lock’ system.

You can choose whether you’d like your UK State Pension to be paid to a UK bank account or a local account in Belgium, but you should be aware that payments are only ever made in GBP. Therefore, fluctuating exchange rates and banking charges for international payments could impact the amount you receive.

Managing Pension Funds When Relocating From the UK to Belgium

The next consideration is how to deal with private pension funds and retirement savings following your move – which may depend on the pension products you have. For example, caution is advisable when deciding whether to withdraw or transfer a defined benefit pension with a high final value due to the guaranteed income this type of pension provides.

If you decide to transfer a defined benefit pension plan or any pension scheme with safeguarded benefits worth over £30,000, you are obligated to seek independent financial advice.

Otherwise, three main options may apply, depending on a thorough evaluation of your finances, broader portfolio and whether you are taking early retirement:

- Transferring a UK-based pension fund to an approved scheme on the HMRC Recognised Overseas Pension Scheme (ROPS) list.

- Leaving a UK pension as-is and withdrawing payments as a lump sum or regular deposits into either a British or Belgian bank account.

- Opting for a Self-Invested Personal Pension (SIPP) – a tax wrapper that provides many tax advantages similar to a ROPS, but without transferring the fund outside the UK.

Both transfer options outlined here can be beneficial in terms of providing greater freedom to customise how your pension funds are invested, but there remain pros and cons to be mindful of. ROPS and SIPPs provide access to a lump sum of up to 30% and 25%, respectively, provided you are 55 or above in most cases.

These lump sum withdrawals are not exposed to UK tax but could potentially be taxable in Belgium if you relocate before making the deduction. Likewise, if you live in Belgium long term and are categorised as a tax resident, you must account for local taxation on your pension income.

We advise any expat planning a cross-border move to consult one of our skilled financial advisers before making any decisions about the best ways to manage a UK pension fund.

Belgian Tax Obligations for Foreign National Retirees

Once you have restructured or transferred your pension scheme and any other retirement savings, you’ll also need to evaluate the tax deductions you can expect to pay.

If you plan on living in Belgium long-term, you will normally become a tax resident, which means you are liable to pay Belgian tax on your worldwide income. Non-residents, in contrast, only pay local taxes on earnings that arise within the country.

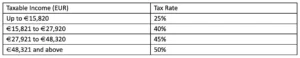

The current tax brackets applied to net taxable income following the deduction of social security charges are as follows:

Like many EU countries, additional and variable communal taxes are charged against income, depending on where you decide to live. The average local income tax rate is 7%, which is the same rate charged as a flat rate on all non-resident income.

Tax reductions apply, which depend on your total taxable earnings. The personal tax-free allowance for income earned in 2024 is €10,570. Other taxes will apply to retirees as to any other resident, including inheritance, gift and property taxes.

Professional Pension Planning Support for Retirement in Belgium

There are multiple potential ways to manage your pension funds when relocating to Belgium, and the high-income tax rates might make a considerable difference to your net income. The best way forward is always to create a tailored plan based on your retirement savings and other assets, ensuring you take advantage of tax efficiencies available.

For more information about managing your pension before moving to Belgium, calculating your ongoing tax obligations as a foreign national Belgian resident, or analysing the right approach to transferring your pension fund, please get in touch with the Chase Buchanan Wealth Management team.

Our Belgian office is located in Brussels, and you are welcome to contact our local team to arrange a convenient time to discuss your retirement plans. Working with an experienced adviser with a grasp of the tax regime in Belgium and back in the UK ensures you receive independent, personalised advice and can make clear decisions about the right solutions for your financial future.

*Information correct as of April 2024